Cash Flow Problems: The Silent Killer of Profitable Retail Stores

His profitable store was about to collapse in 16 hours.

This is the brutal reality of cash flow problems in retail. They don't give you a month's notice or wait for a convenient time. One day you're celebrating record sales, the next day you're staring at a bank balance that won't cover tomorrow's payroll.

After 16 years building retail businesses and working with hundreds of store owners, I've watched cash flow problems destroy more profitable stores than recessions, online competition, or rising rents combined. These aren't isolated incidents—they're epidemic.

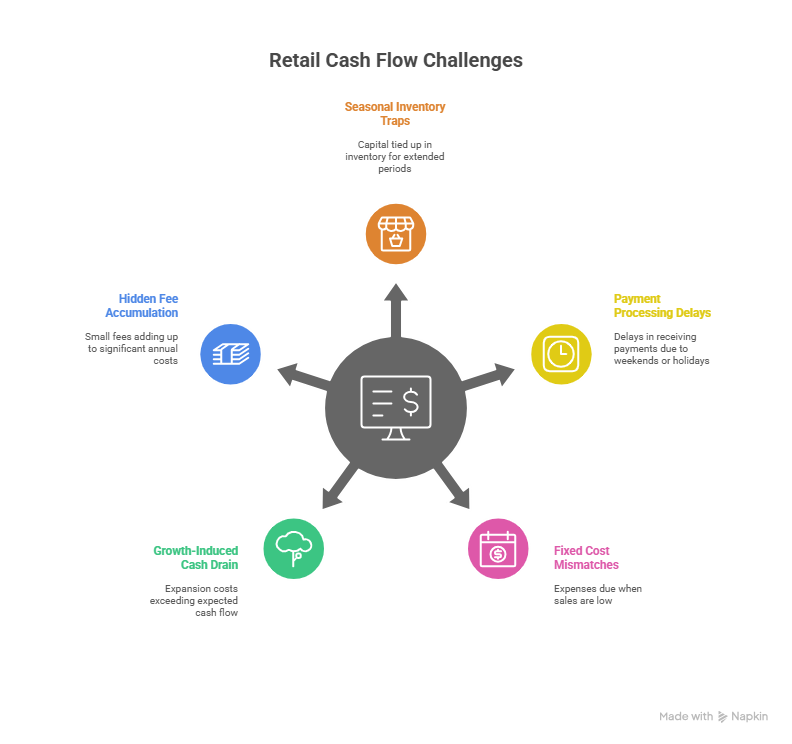

The 5 most common cash flow problems killing profitable retail stores are:

Seasonal inventory cash traps - Working capital locked up months before sales occur

Payment processing delays - Weekend and holiday deposit delays creating weekly gaps

Fixed cost timing mismatches - Rent, payroll, and insurance hitting when sales are low

Growth-induced cash drain - Expansion costs depleting reserves faster than expected

Hidden fee accumulation - Small monthly charges that compound into major annual drains

The difference between stores that survive these cash flow problems and stores that close isn't profitability—it's recognizing the warning signs early and knowing exactly what moves to make when you need cash in your account by Friday morning, not next month.

In this article, you'll discover how each of these problems operates, the early warning signs most owners miss, and the emergency tactics that work when conventional advice is too slow and your back is against the wall.

What Are Cash Flow Problems in Retail?

Cash flow problems happen when you don't have enough ready cash to pay your bills, even when your store is making money. It's the nightmare scenario where your sales are strong, your customers are happy, but you're still lying awake Sunday night wondering how you'll make Monday's payroll.

Here's the brutal difference most retail owners discover too late: profit lives on paper, but cash flow lives in your bank account.

When you sell $15,000 worth of merchandise on Saturday, your accounting software celebrates the sale immediately. Your bank account? That's a different story. The cash won't appear until Tuesday—if you're lucky. But your staff wants their paychecks Monday morning, your rent auto-withdraws Tuesday at midnight, and your supplier payment is already three days overdue.

This timing mismatch is what turns profitable retail stores into financial pressure cookers.

Why Cash Flow Problems Hit Retail Stores Like a Sledgehammer

Retail businesses are sitting ducks for cash flow problems because of how the industry operates:

Inventory Hostage Situations: That beautiful spring collection you ordered in December? Your cash is trapped in those products for months before customers start buying. A boutique owner recently told me she had $47,000 tied up in summer inventory while scrambling to find $3,200 for February payroll.

Seasonal Revenue Whiplash: December delivers $95,000 in sales, then January crashes to $18,000. Your mortgage company doesn't care. Your employees still need paychecks. Your insurance premium doesn't pause for slow months.

Processing Purgatory: Credit card companies hold your weekend sales hostage until Tuesday. During holiday weekends, $30,000+ in customer payments can sit in digital limbo while your bills demand immediate attention.

Physical Space Prison: Unlike online businesses that can operate from kitchen tables, you're chained to expensive real estate. That $8,500 monthly rent hits whether you sell one item or one thousand.

The "Profitable But Broke" Nightmare

This paradox destroys more successful retail businesses than economic downturns. Your profit margins look healthy, your customer base is loyal, and your community reputation is solid. Everything screams "success."

Except you're checking your bank balance four times a day. Using your personal credit card for business expenses. Asking suppliers for extended payment terms. Making excuses about when staff paychecks will clear.

I've sat across from retailers with 18% profit margins who couldn't afford a $200 emergency repair because every dollar was trapped in inventory, outstanding receivables, or processing delays.

The faster you understand that cash flow problems and profit problems are completely different financial diseases requiring completely different treatments, the faster you can stop the bleeding and start breathing again.

The 5 Cash Flow Problems Destroying Profitable Retail Stores

These aren't theoretical problems you might encounter someday. These are the five cash flow problems that show up like clockwork in retail businesses, turning profitable operations into financial nightmares. After working with hundreds of store owners, I've seen these same patterns destroy more successful businesses than all other challenges combined.

Problem #1: Seasonal Inventory Cash Traps

The calendar doesn't care about your cash flow, but your inventory decisions can trap you for months.

Every retail owner knows the drill: holiday merchandise gets ordered in August, spring collections arrive in February, and summer stock hits your floor while customers are still buying winter clearance. Each ordering cycle locks up massive chunks of working capital months before you see a single sale.

Here's how the cash trap works: David runs a successful home goods store that does $1.2 million annually. Every February, he places his spring orders—garden furniture, outdoor décor, patio accessories. Total investment: $67,000. His cash immediately disappears from his business account, but his spring selling season doesn't start until late April.

That's 10-12 weeks of zero return on a massive cash investment. Meanwhile, February and March are his slowest sales months, generating maybe $28,000 combined. But his rent, payroll, utilities, and loan payments don't pause for seasonal cycles.

The result? A profitable store owner using credit lines to cover basic expenses while $67,000 of his own money sits on shelves gathering dust.

The 90-day cash conversion nightmare: Most retail inventory follows a 90-day cycle from purchase to sale to bank deposit. But your expenses operate on a 30-day cycle. This timing mismatch creates predictable cash crunches that hit profitable stores like a sledgehammer.

The trap deepens when slow-moving inventory extends that conversion cycle to 120, 150, or even 200 days. Suddenly, your spring merchandise is still sitting in storage when it's time to order fall inventory.

Problem #2: Payment Processing Time Bombs

Your customers pay immediately. Your bills are due immediately. But your cash sits in digital purgatory for days—sometimes weeks.

The weekend deposit death trap hits retail stores every Monday morning. Friday and Saturday are your biggest sales days, but credit card processors don't work weekends. That $15,000 in weekend sales won't hit your account until Tuesday at best. If Monday is payroll day, you're scrambling to cover wages with money that's technically yours but practically invisible.

During holiday weekends, this processing delay stretches even longer. Memorial Day weekend sales might not clear until Thursday, creating a five-day cash gap when your business is at its busiest.

Real crisis scenario: A children's clothing boutique generated $12,000 in back-to-school weekend sales—their biggest sales weekend of August. Monday morning brought a Stripe "account review" that froze their payouts for eight days while the company "verified recent transaction patterns."

For eight days, $12,000 of the owner's money sat locked in digital limbo while she covered payroll from personal savings, delayed supplier payments, and watched her business credit utilization climb toward dangerous levels.

The small print nightmare: Processors don't just delay payments—they hold them hostage. "Risk management protocols" can freeze your account based on "unusual activity patterns" like selling more than expected, processing larger transactions, or having seasonal sales spikes.

Your reward for business success? Your own money held captive until some algorithm decides you're not a fraud risk.

Problem #3: Fixed Cost Avalanche

Your expenses hit like military precision. Your revenue flows like a leaky faucet.

Every retail business gets crushed by the same brutal math: fixed costs arrive on schedule regardless of sales performance. Rent auto-withdraws on the 1st, payroll processes every other Friday, insurance premiums hit quarterly, and loan payments never miss their due dates.

Meanwhile, your daily sales swing wildly. Tuesday generates $2,800, Wednesday brings $890, Thursday climbs to $3,200. Weekly totals might range from $12,000 to $28,000 depending on weather, local events, or customer mood.

The perfect storm scenario: A sporting goods store faced three major expenses in one week: $8,400 rent due Monday, $6,200 bi-weekly payroll processing Friday, and $3,800 quarterly insurance premium auto-withdrawing Wednesday. Total cash outflow: $18,400.

That same week, sales dropped 40% due to unexpected rain during their busiest season. Instead of the projected $22,000 in sales, they generated $13,200. The math doesn't work, but the bills don't care.

The death spiral decision: When cash flow problems hit, most retailers make the same deadly choice—they cut marketing first. It seems logical: marketing is discretionary, rent isn't.

But cutting marketing during cash flow stress creates a vicious cycle. Lower marketing spend reduces customer traffic, which decreases sales, which worsens cash flow, which forces more marketing cuts. I've watched profitable stores circle the drain this way, starving themselves of customers while trying to preserve cash.

Problem #4: Growth-Induced Cash Drain

Success can kill your business faster than failure.

The cruelest cash flow problems hit retailers who are doing everything right. Growing customer base, expanding inventory, planning new locations—all the signs of business success that drain cash faster than a bathtub with no plug.

The expansion cash trap: Opening a second location requires security deposits, first month's rent, equipment purchases, initial inventory investment, and marketing launch costs before you earn a single dollar of revenue. Most retailers underestimate this initial cash requirement by 40-60%.

Real-world destruction: A jewelry store owner opened her second location after five successful years at her original store. The new location required $45,000 upfront: $8,000 security deposit, $12,000 for fixtures and displays, $18,000 for opening inventory, $4,500 first month's rent, and $2,500 for marketing launch.

Three months later, the new location was generating $22,000 monthly—ahead of projections and profitable on paper. But the initial $45,000 investment had drained her original store's cash reserves during their seasonal slow period. She couldn't restock core inventory at her successful original location because all her working capital was tied up making the new location successful.

The result? Two profitable locations and a business owner who couldn't sleep at night because both stores were operating on financial fumes.

Double rent devastation: Store relocations create unique cash flow problems because you're often paying rent on two locations simultaneously. Old lease expires March 31st, new lease starts February 1st. Two months of double rent plus moving costs plus new location setup can consume months of profit in weeks.

Problem #5: The Hidden Fee Death Spiral

Small monthly fees are financial termites—individually harmless, collectively devastating.

Most retail owners focus on big expenses like rent and inventory while small monthly fees devour their cash flow $50-$200 at a time. These "convenience" charges multiply faster than rabbits and often auto-renew without warning.

The subscription death by a thousand cuts: Point-of-sale systems charge $89 monthly. Credit card processing takes 2.9% plus $0.30 per transaction. Inventory management software costs $127 monthly. Email marketing platform runs $78 monthly. Security system monitoring adds $65 monthly. Website hosting and maintenance totals $95 monthly. Accounting software subscription costs $68 monthly.

Individual fees seem reasonable. Total monthly damage: $522. Annual cash drain: $6,264.

The compounding crisis: A gift shop owner discovered she was paying $347 monthly in various subscriptions and fees—$4,164 annually. During her slowest quarter, these "small" fees represented 23% of her total expenses while generating zero additional revenue.

But here's the real killer: most of these fees auto-renew and auto-increase. That $89 POS system becomes $99 after year one, $109 after year two. Credit card processing rates creep up from 2.9% to 3.1% to 3.3%. Software subscriptions add "premium features" and charge accordingly.

The cancellation nightmare: When cash flow problems hit and you need to cut expenses fast, subscription services make cancellation nearly impossible. 30-day notices, early termination fees, annual contracts, and "retention specialists" who offer temporary discounts instead of cancellations.

You're trapped paying for services you can't afford to keep your business that can't afford to lose them.

These five problems don't operate in isolation—they compound each other. Seasonal inventory traps reduce available cash right when processing delays hit. Fixed cost avalanches coincide with growth investments. Hidden fees drain resources during slow periods.

Understanding how each problem works is the first step. Recognizing when they're attacking your business is the second. Knowing exactly what to do when you need cash in your account by Friday morning—that's what separates stores that survive from stores that close.

Seeing your store trapped in these scenarios? You're not alone, and you're not out of options.

These five cash flow problems don't have to destroy what you've built. There are immediate moves you can make—even when it's Thursday afternoon and you need cash in your account by Friday morning.

Download '3 Emergency Moves to Solve Cash Flow Fast' - proven tactics that work when conventional advice is too slow and your back is against the wall. These aren't long-term strategies that take months to implement. These are emergency maneuvers that generate cash within 24-72 hours when you need it most.

7 Warning Signs Your Profitable Store Has Cash Flow Problems

Cash flow problems sneak into profitable retail businesses like carbon monoxide—silent, invisible, and deadly. By the time you notice the symptoms, you're already in danger.

If you're reading this list thinking, "That sounds like normal business stress," you're not managing entrepreneurial challenges—you're managing a financial emergency that's masquerading as routine operation.

1. The Sunday Night Bank Balance Ritual

You know you shouldn't check your business account at 11:47 PM on Sunday. You know nothing has changed since Saturday afternoon. You check anyway.

Why this is dangerous: You're not checking because you're curious—you're checking because you genuinely don't know if there's enough money to cover Monday's expenses. That uncertainty isn't entrepreneurial anxiety. It's your brain screaming that your cash flow problems have hijacked your peace of mind.

The 3 AM wake-up call: When you find yourself calculating whether Friday's deposits will clear before Monday's auto-withdrawals, you've crossed from business management into financial crisis management.

2. Credit Lines Have Become Life Support

Your business line of credit was supposed to fund growth opportunities and handle genuine emergencies. Instead, it's become your monthly financial oxygen tank, keeping your profitable business alive.

The monthly dependency cycle: Every month, you tap $8,000-$15,000 to cover predictable expenses like payroll and supplier payments. Every month, you promise yourself this is the last time. Every month, the cycle repeats.

Why this kills businesses: You're paying 8-12% interest to fund normal operations of a profitable company. That interest expense could be reinvested in inventory, marketing, or growth—but instead, it's the tax you pay for having cash flow problems.

3. The Supplier Shuffle

You've perfected the art of strategic payment delays. Net-30 becomes Net-45 with a phone call. Partial payments buy you another two weeks. You've memorized which suppliers are most flexible with late payments.

The relationship poison: Your suppliers are starting to notice patterns. They're discussing cash terms, shortening payment windows, or requiring deposits. Each conversation chips away at relationships you spent years building.

The vendor death spiral: Eventually, suppliers stop extending credit entirely, forcing you to pay cash upfront precisely when you have the least cash available.

4. Opportunity FOMO Becomes Survival FOMO

That $12,000 inventory closeout deal isn't a bad investment—it's a 40% markup opportunity you can't afford to take because you need that cash to make payroll next week.

The growth ceiling trap: Cash flow problems force you to turn down profitable opportunities while watching competitors expand using deals you discovered but couldn't afford.

Real-world devastation: A pet store owner found a $8,000 premium dog food closeout that would generate $14,000 in holiday sales. She passed because she needed that $8,000 for January rent. Her competitor bought the inventory and dominated holiday sales while she struggled with limited premium options.

5. When Your Team Questions Payroll

The conversation starts casually: "Hey, when do checks usually clear?" or "Just checking when payroll hits the bank."

The trust destruction: Your employees are essentially asking if their paychecks are reliable. They're planning their personal finances around uncertainty about their income from your profitable business.

The talent drain accelerator: Your best employees—the ones with options—start looking for "more stable" positions. You're about to lose your strongest team members during your weakest financial period.

6. Profitable Months That Breed Panic

December: $78,000 in sales, $22,000 in profit margins. February: scrambling to find $3,400 for basic expenses.

The profitable-but-broke insanity: Your accounting software celebrates profit while you're using personal credit cards for business expenses. The money exists on paper but lives in inventory purgatory or processing delays.

The success punishment: Strong sales months make your cash flow problems worse because they tie up more working capital in products and receivables.

7. Weekend Sales Create Weekend Stress

Saturday brings $16,000 in sales. Instead of celebrating, you're calculating when that money will actually reach your account and whether it'll arrive before Wednesday's major expenses.

The success anxiety disorder: Big sales days create stress instead of joy because you know the cash timing won't match your bill timing.

The holiday weekend nightmare: Three-day weekends become financial horror shows when $25,000 in sales sits frozen in processing while your weekly expenses march forward like clockwork.

Your Crisis Reality Check

If 1-2 warning signs sound familiar: You're developing cash flow problems that need immediate attention before they become critical.

If 3-4 signs describe your routine: Your cash flow problems are actively damaging your business and need emergency intervention.

If 5-7 signs define your daily reality: Your profitable business is in financial crisis mode. You need emergency tactics that work within 24-72 hours, not long-term planning advice.

The brutal truth? These aren't growing pains or normal business challenges. These are symptoms of cash flow problems that destroy profitable retail businesses every month.

But here's what most business advisors won't tell you: every one of these problems has an immediate solution that works even when your back is against the wall.

The True Cost of Ignoring Cash Flow Problems

Ignoring cash flow problems is like ignoring chest pains because you're too busy to deal with a heart attack. The damage spreads way beyond your business bank account.

I've sat across from grown men who built million-dollar retail empires, watching them break down because they waited too long to address timing issues that had simple solutions six months earlier.

What It Does to Your Family

Your spouse didn't marry a business owner who brings financial stress to every family dinner. But that's what happens when cash flow problems move into your house.

You're checking your phone at your kid's soccer game, calculating whether Saturday's sales will clear before Monday's payroll. Your family vacations get canceled because you need that $8,000 for inventory instead of the beach house rental you promised months ago.

The personal guarantee trap hits hardest at home. That SBA loan with your signature becomes a family problem when business cash flow goes sideways. Your mortgage, your kids' college funds, your retirement savings—all at risk because your profitable store can't time payments properly.

Sarah, who owns three boutiques, told me she hadn't slept through the night in eight months. Not because her stores weren't profitable—they were crushing their numbers. But because she was personally guaranteeing $180,000 in business debt while her cash flow swung like a pendulum.

What It Does to Your Business

You start declining opportunities that your competitors grab. That closeout inventory deal, that prime second location lease, that holiday marketing campaign—you say no because you need cash for payroll, not growth.

Your suppliers start treating you differently. Twenty-year relationships turn cold when you consistently push payment terms. They stop calling with special deals. They start demanding deposits. Eventually, some require cash upfront, eliminating your working capital cushion entirely.

Your best employees leave for "more stable" jobs. They don't quit because your store is failing—they quit because uncertainty about paychecks makes them nervous. You lose trained staff during your most vulnerable period, forced to hire and retrain when you can least afford the disruption.

Mike runs a sporting goods store that employs 12 people. Three of his key employees left within two months when payroll started hitting accounts on Tuesday instead of Friday. "They didn't trust the timing anymore," he told me. "And honestly, I didn't blame them."

What It Does to Your Community Standing

In retail communities, word travels fast. Vendors talk to each other about payment patterns. Employees talk to friends about payroll uncertainty. Customers sense operational stress even when they can't identify it.

Your community reputation—built over decades—erodes quickly. You're not just losing supplier relationships; you're losing the community standing that makes retail businesses successful in small towns and neighborhoods.

When cash flow problems force profitable stores to close, the damage spreads beyond your family and employees. Empty storefronts hurt neighborhood property values. Lost jobs affect local families. Community gathering places disappear.

The Long-term Devastation

Here's the cruelest part: cash flow problems destroy profitable businesses that should have survived and thrived. You didn't build your store to fail because of timing issues. You built it to create security, maybe pass it to your kids, or sell it to fund retirement.

Cash flow problems turn legacy businesses into distressed sales. Buyers don't want to inherit timing issues, regardless of profitability. Your retirement security disappears along with your business value.

I've watched retail owners lose businesses worth $400,000 on paper for $80,000 in distressed sales because cash flow problems made them unsellable at fair value.

The tragedy isn't just what you lose—it's what you never get the chance to build. Every month you spend managing survival instead of growth is a month you can't get back.

Why This Hits Retail So Hard

Retail owners are product experts, not financial experts. You know your inventory inside and out, but cash flow timing doesn't come naturally. Most business advice treats cash flow like an accounting problem instead of an operational emergency.

The recovery timeline is brutal. Fixing cash flow damage after it's destroyed relationships, reputation, and family security takes 3-5 times longer than preventing it. You're not just rebuilding your business—you're rebuilding trust.

But here's what I've learned from working with hundreds of retailers: cash flow problems have immediate solutions that work even when everything feels hopeless.

Don't let cash flow problems destroy what you've built.

You've invested too much of your life in this business to watch it die from timing issues. Your family deserves better than financial stress from a profitable company. Your community needs you to succeed.

Get '3 Emergency Moves to Solve Cash Flow Fast'—proven tactics that work when you need cash this week, not next quarter. These aren't theory from someone who's never made payroll on Friday morning with $200 in the bank. These are emergency moves from someone who's been there and knows what actually works.

FAQ - Cash Flow Problems in Retail Stores

Q: What's the most common cause of cash flow problems in retail stores?

A: Seasonal inventory timing traps. You order spring merchandise in December, tying up $40,000-$80,000 for months before seeing any sales. Meanwhile, December and January are often your slowest revenue months, but your fixed expenses don't pause for seasonal cycles.

I've watched a home goods store owner invest $67,000 in spring patio furniture in February while struggling to find $3,800 for payroll. The inventory was profitable—it would generate $115,000 in sales by June. But June doesn't help when you need cash in February.

Q: Can profitable retail stores really have cash flow problems?

A: This catches more retail owners off guard than any other financial issue. Your P&L statement shows healthy profit margins, customers are buying, and your business model works. But cash flow problems don't care about paper profits.

Profit gets recorded the moment you make a sale. Cash flow reflects when that money actually hits your bank account and becomes available. A furniture store can show $18,000 in weekend profits while the actual cash sits in credit card processing for three days, creating a gap when Monday's payroll is due.

Q: How quickly can cash flow problems kill a retail business?

A: Faster than most owners realize. A profitable retail store can be forced to close within 30-60 days once cash flow problems reach critical mass.

The speed depends on your fixed costs and cash reserves. If your monthly expenses total $35,000 and you have $12,000 in reserves, you have roughly 10 days to solve cash flow timing issues before you're forced into crisis decisions like missing payroll or defaulting on rent.

Q: What's the difference between cash flow problems and profit problems?

A: Profit problems mean your sales don't cover your costs—you're losing money on operations. Cash flow problems mean you're making money, but it's trapped in inventory, tied up in processing, or delayed by payment timing.

Think of it this way: profit problems require new customers or higher prices. Cash flow problems require better timing of when money moves in versus when money moves out. Completely different diseases requiring completely different treatments.

Q: When should retail owners seek help for cash flow problems?

A: The moment you recognize the early warning signs—checking your bank balance multiple times daily, using credit lines for regular operations, or feeling anxiety about weekend sales because of processing delays.

Don't wait until you're scrambling for Friday's payroll. Cash flow problems are easier to fix when they're warning signs rather than when they're full-blown crises. Early intervention takes days to implement; crisis management takes months to recover from.

Q: What's the fastest way to solve retail cash flow problems?

A: Emergency cash conversion tactics that work within 24-72 hours: converting slow-moving inventory to immediate cash, accelerating customer payment terms, and strategically timing major expenses.

The key is distinguishing between long-term cash flow management and emergency cash generation. When you need money in your account by Friday morning, you need tactics that create immediate liquidity, not six-month planning strategies.

Q: Are cash flow problems normal for retail businesses?

A: Cash flow challenges are common in retail due to inventory cycles and seasonal patterns, but cash flow problems that cause operational stress aren't normal—they're preventable.

Many retail owners accept financial anxiety as "part of the business," but constantly worrying about payroll timing or checking bank balances multiple times daily indicates serious issues that need immediate attention.

Q: Can you have cash flow problems with strong sales?

A: Absolutely, and this scenario destroys more profitable retail businesses than weak sales do. Strong sales can actually worsen cash flow problems by tying up more working capital in inventory and creating larger processing delays.

A clothing boutique had their best sales month ever—$89,000 in December. But that success required $45,000 in additional inventory purchases in October, depleting their cash reserves right before their biggest revenue month. They ended December profitable on paper but scrambling for January rent money.

From Cash Flow Crisis to Cash Flow Control

Cash flow problems don't pick favorites. They'll destroy a thriving $100K boutique just as brutally as a million-dollar retail empire. I've watched both scenarios play out, and the financial devastation looks identical—profitable businesses closing their doors because of timing issues that had immediate solutions.

The difference between retail owners who survive cash flow storms and those who don't isn't luck, size, or even profitability. It's recognizing the warning signs before they become critical and knowing exactly what moves to make when the pressure hits.

You Now Know What Most Retail Owners Miss

The 5 cash flow problems we've covered—seasonal inventory traps, payment processing delays, fixed cost avalanches, growth-induced drains, and hidden fee accumulation—account for roughly 90% of retail cash flow crises.

But here's what separates this knowledge from transformation: most retail owners can diagnose their cash flow problems perfectly but have no idea what to do about them.

They know their spring inventory is tying up $50,000 for three months. They understand that weekend sales won't clear until Tuesday. They recognize that fixed costs hit regardless of daily sales fluctuations. They can identify every warning sign and consequence we've discussed.

Yet they're still checking their bank balance at midnight, using credit lines for payroll, and declining profitable opportunities because cash is trapped in inventory purgatory.

Knowledge Without Action Changes Nothing

Understanding cash flow problems doesn't solve them. You need a concrete action plan that works when you're facing Friday's payroll with Thursday's bank balance and no time for long-term planning strategies.

You need emergency tactics that generate cash within 24-72 hours, not financial advice that takes months to implement. You need moves that work when conventional wisdom is too slow and your back is against the wall.

After 16 years in retail and working with hundreds of store owners facing these exact crises, I've identified the three emergency moves that consistently work when time has run out and options have disappeared.

These aren't theories from textbooks or strategies from consultants who've never made payroll on Friday morning with $200 in their business account. These are battlefield-tested tactics that work when everything else has failed.

Your Next Move Determines Everything

You have two choices right now:

Option 1: Close this article, hope your cash flow problems resolve themselves, and continue the cycle of Sunday night anxiety, daily bank balance checking, and credit line dependency until something breaks permanently.

Option 2: Take immediate action with proven emergency moves that work even when your situation feels hopeless and your timeline feels impossible.

Most retail owners choose Option 1 because it requires no immediate commitment. But Option 1 doesn't solve anything—it just delays the inevitable crisis until the stakes are higher and the solutions are harder.

The retailers who survive and thrive choose Option 2. They recognize that cash flow problems have immediate solutions and they take action before crisis becomes catastrophe.

Ready to transform cash flow anxiety into predictable cash control?

You've invested too much of your life building this business to watch it struggle with timing issues that have proven solutions. Your family deserves better than financial stress from a profitable company. Your employees deserve paycheck certainty. Your community needs your business to succeed.

Download your FREE guide: '3 Emergency Moves to Solve Cash Flow Fast'

These aren't long-term strategies that take months to see results. These are proven tactics you can implement when payroll is due Friday and your account is short. The same emergency moves that have helped hundreds of profitable retail stores go from crisis to control in less than a week.

Stop managing survival. Start controlling your cash flow.

Get your free guide now—because your business deserves financial peace of mind, and you deserve to sleep through the night again.